Business students must think or swim in financial contest

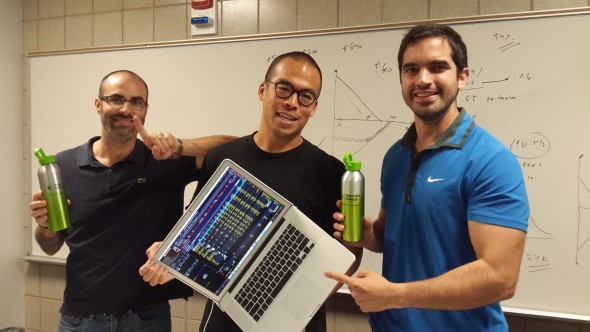

Jon Spurgeon (from left), Jason Chiou and Matias Jalil Caceres Arar put trade theory into practice during the TD Ameritrade U thinkorswim Challenge.

Four students in the UIC Liautaud Graduate School plunged into the TD Ameritrade U thinkorswim Challenge, fighting to stay afloat among 475 other college teams for one month.

The contest, sponsored by TD Ameritrade Services Company Inc., started Oct. 12 and ended Nov. 7 — a full four weeks of putting trade theories into practice. Prizes were given to groups that made the most money in the four-week span.

In its second year, the annual contest gave students access to educational and professional-level trading tools and platforms to experience what it’s like to trade in the real world and in real time. Each team was given $500,000 in paper money for four weeks of practice before the competition began, then $500,000 in paper money as it started.

“The platform is the conduit to the market,” said Jason Chiou, MBA candidate in finance and entrepreneurship.

“We got to apply what we learned in class in practice. Because you can learn the fundamentals of how to trade a stock, but once you actually do it, it’s a totally different ballgame. Minute by minute, things change.”

Chiou and his team members — Matias Jalil Caceres Arar, Jon Spurgeon and Sergey Bulakov — are part of the UIC Graduate Finance and Investment Group. They jumped in knowing little to nothing about options trading, their chosen focus.

“You learn the theory behind how they work but when you actually trade options, it gives you this practical experience that you can’t really learn in class,” said Caceres Arar, a Fulbright scholar from Paraguay. He hopes to return to Paraguay after completing his MBA to make positive contributions in capital markets, finance and business.

Options trading allows investors to secure, or lock-in, a buying or selling price that the options buyer has a right to exercise whether the market price rises or falls.

“We pretty much had a crash course about options,” Chiou said.

The team learned how emotions can result in greed, upset or panic. One day, the team lost $100,000. Another day, they made $150,000.

“It’s not real money, but there were still emotions behind everything,” Caceres Arar said. “How do you manage that emotion of not selling when prices are falling? Those things can’t be taught.”

Some things the team learned in the classroom came in handy, though — like the bull put spread and iron condor strategy. They plan to take a course on options next semester.

Although the UIC students didn’t land in the top 10 this year, they plan to compete again and make their own investments.

“The lessons that we learned from this were invaluable. Hopefully next year, we’ll be trading with real money,” Chiou said.